Exponential wealth: How your money can grow over time

June 15, 2018

If there is one lesson we should teach our children as soon as they are old enough to understand, it is the power of compound interest.

It’s the simple concept that the interest you earn on your savings also earns interest.

It’s an example of exponential growth, and the reason to get ‘em while they’re young is that time enhances the returns dramatically.

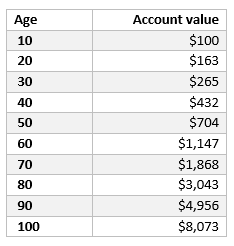

Here’s a simple scenario: David has just turned 10 and decides to put $100 of his birthday money into an account earning 5% per annum (pa).

He reckons he has a good chance of living to 100 and plans on throwing a big birthday party to celebrate.

Here’s how his savings would grow:

It’s definitely not a get-rich-quick scheme, but it shows the snowball effect of compounding interest.

Those modest initial returns are swamped by the returns in the later years.

In the first decade he earns just $63 in interest. In the tenth decade interest income is more than $3,000.

Adjust the interest rate

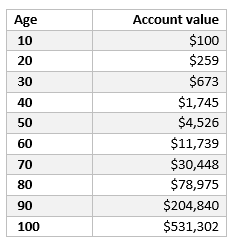

Another big influence on the outcome of compounding returns is the interest or earnings rate.

How does David fare if he manages to average a return of 10% pa over the same time frame?

Now we’re getting somewhere.

By simply doubling his rate of return, David has lifted the final value of his savings by more than 65-fold!

Of course, David needs to appreciate that higher returns come with higher risks, but with time on his side that risk may well be worth taking.

Also, it’s the effective interest rate that is important – the actual interest earned after tax, inflation and any investment costs are taken into account.

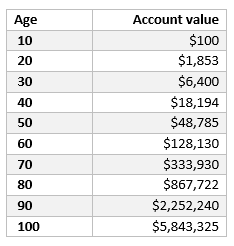

Add some contributions

Aside from time and interest rates, there’s another way in which David can really help his savings grow: additional contributions.

By adding just $100 extra per year to his big birthday bash fund, and targeting a rate of 10% pa, his future savings now look like this:

Wow! That will be some party.

By adding just $8,900 in additional contributions, David has increased his final savings figure by more than $5.3 million.

Even at age 70, David’s extra contributions of just $5,900 over 60 years boosted his savings by more than $300,000.

So, start early, target a sensible long-term rate of return, make additional contributions and let time work its magic.

You may not get rich quick, but compound interest is the simple secret to growing rich over time.

Start now

While exponential growth is the engine room of wealth creation, other issues such as tax and investment risk also need to be addressed.

This is equally the case when setting up savings plans for children.

LDB can help you design an effective wealth creation strategy tailored to your needs.

To find out more call us on (03) 9875 2900, or fill in the contact form below and we’ll be in touch.