News

Audit & Financial Reporting

Significant changes to owners’ corporation: what are they?

Significant reforms to the way owners’ corporations operate in Victoria are now in effect. Here’s what you need to know.

Wealth Management

8 things you can do with your surplus cash flow or savings

If your household’s income exceeds your annual expenses, you may have built up surplus cash. Here’s what you can do with it.

Tax Compliance & Accounting

6 misconceptions about Australian taxation of cryptocurrency

From whether cryptocurrency is a currency for tax purposes to if cryptocurrency as a hobby is taxable, Florence Ioannou sets the record straight.

Superannuation

Changes to superannuation rules from July 1, 2022

Proposed changes to superannuation were passed by both houses of parliament on February 10, 2022. Here's what you need to know.

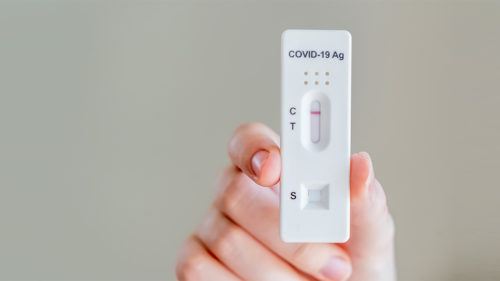

Tax Compliance & Accounting

COVID-19 tests to be tax deductible – here’s how to claim them

Superannuation

Can I live in my SMSF property once I retire?

Wealth Management

Outlook uncertain as pandemic-related economic disruptions continue

The economic outlook for the year ahead remains uncertain as Australia experiences price rises and an increase in inflation.

Tax Compliance & Accounting

TFN: What is a Tax File Number and why do I need one?

Here’s what you need to know about Tax File Numbers, and how they impact both businesses and the people they employ.

Tax Compliance & Accounting

Key takeaways of the Mid-Year Economic and Fiscal Outlook 2021-22

The federal government has shared the Mid-Year Economic and Fiscal Outlook, and we’ve rounded up the major highlights of the report.

Real Estate Advisory

Your guide to Victoria’s Homebuyer Fund

Victorians can apply for the Homebuyer Fund with just a 5 per cent deposit, but there are some eligibility requirements you need to know about.

Business Advisory

ABN: what is an Australian Business Number and when do I need one?

Here’s what you need to know about getting an ABN and why it should be a priority for business operators and sole traders.

Tax Compliance & Accounting

Updated guidelines on allocation of professional firm profits PCG 2021/D2

The Australian Taxation Office has released new guidance for the allocation of professional firm profits. Here’s what you need to know.

Business Advisory

Director ID: why you need one and how to apply

Director IDs are being introduced across Australia, in an effort to detect and deter unlawful activity. Here’s what you need to know.

Superannuation

Superannuation updates: thresholds, contributions, audit

There have been several updates to superannuation recently, and it is important to remain informed. Here are the key changes you should know about.

Company News

LDB Group makes AFR’s Top 100 Accounting Firms 2021 list

LDB Group has claimed a spot in the Australian Financial Review’s Top 100 Accounting Firms for 2021.