Tax Compliance & Accounting

Tax Compliance & Accounting

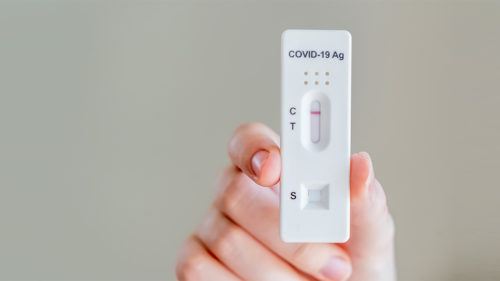

COVID-19 tests to be tax deductible – here’s how to claim them

Tax Compliance & Accounting

TFN: What is a Tax File Number and why do I need one?

Here’s what you need to know about Tax File Numbers, and how they impact both businesses and the people they employ.

Tax Compliance & Accounting

Key takeaways of the Mid-Year Economic and Fiscal Outlook 2021-22

The federal government has shared the Mid-Year Economic and Fiscal Outlook, and we’ve rounded up the major highlights of the report.

Tax Compliance & Accounting

ABN: what is an Australian Business Number and when do I need one?

Here’s what you need to know about getting an ABN and why it should be a priority for business operators and sole traders.

Tax Compliance & Accounting

Updated guidelines on allocation of professional firm profits PCG 2021/D2

The Australian Taxation Office has released new guidance for the allocation of professional firm profits. Here’s what you need to know.

Tax Compliance & Accounting

Salary sacrifice arrangements for medical professionals

Medical professionals have the chance to make significant savings by implementing salary sacrifice arrangements. Here’s how it works.

Tax Compliance & Accounting

A beginner’s guide to buying cryptocurrency in Australia

As digital currencies make inroads into mainstream investing, it’s time to demystify the cryptocurrency market. Here’s a guide if you’re starting out.

Tax Compliance & Accounting

Construction industry series: Am I a contractor or an employee?

In the first article of our construction industry series, we share how to determine whether you might be an employee or a contractor.

Tax Compliance & Accounting

Financial support for Victorian businesses hardest hit by lockdowns

Victorian businesses hardest hit by recent COVID-19 lockdowns will be able to access support payments under new and existing initiatives.

Tax Compliance & Accounting

Victorian small businesses eligible for commercial tenancy relief

Tax Compliance & Accounting

Financial support for Victorian businesses impacted by July 2021 lockdown

Following the commencement of Victoria’s fifth lockdown in July 2021, there are several support programs available to eligible businesses.

Tax Compliance & Accounting

Tax rates 2021: Tax brackets for individual income

How much tax you pay depends on a range of factors, including earnings, eligible deductions, and exemptions.

Tax Compliance & Accounting

Circuit Breaker Business Support Package – applications now open

Small and medium businesses impacted by Victoria’s circuit-breaker lockdown restrictions may be eligible for support under new programs.

Tax Compliance & Accounting

Victorian budget 2021-22: Key outcomes for tax, business, property

The Victorian government’s 2021-22 budget focuses on investing in infrastructure, creating jobs, and stimulating economic recovery post-pandemic.

Tax Compliance & Accounting

Video game development tax offset a welcome change of policy

Australia’s video game development industry has received a long-campaigned-for boost as part of the government’s Digital Economy Strategy.