COVID-19 tests to be tax deductible – here’s how to claim them

February 11, 2022

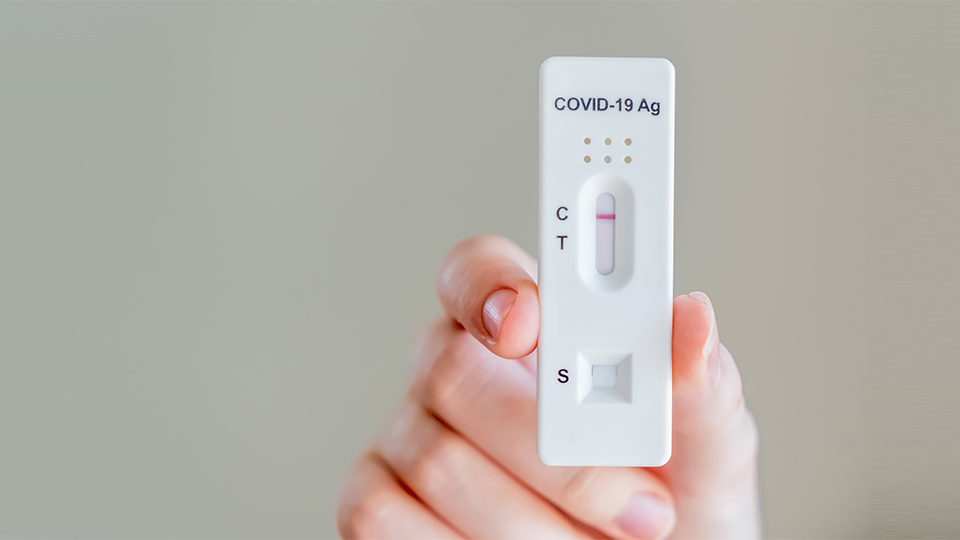

COVID-19 tests, including Polymerase Chain Reaction (PCR) and rapid antigen tests (RATs), will be tax deductible for Australian individuals and exempt from fringe benefits tax (FBT) for businesses when they are purchased for work-related purposes.

The federal government announced the legislation will come into effect from the 2021-22 FBT and income years and will be backdated to July 1, 2021.

This means that individuals who earn an income taxed at 32.5 per cent will receive a tax refund of approximately $6.50 for every dual pack of RATs purchased for $20.

Small businesses will reduce their FBT liability by about $20 for every dual pack of RATs purchased for $20 and provided to employees.

While there are limits on how COVID-19 tests can be claimed under current tax laws, this proposed amendment will clarify that all tests purchased for work-related reasons will be tax deductible for income earners and exempt from FBT for businesses.

The change to make PCR and RATs tax deductible has brought COVID-19 tests “in line with other work-related expenses”, said Treasurer Josh Frydenberg.

“COVID-19 tests are an important tool being used by businesses to protect their workforce and to ensure they can keep their doors open and our supply chains running,” he said.

“As the pandemic has evolved so has our response, and by making common sense decisions like this, we are making it easier for households and businesses to get on with their lives.”

How can you claim COVID-19 tests?

To claim your COVID-19 tests, you’ll need to follow the same steps as you would any other work-related expense.

This means you’ll need to retain proof of purchase, such as a receipt. In cases where obtaining a receipt of an expense is not possible, a detailed record of the purchase can be accepted in another form, such as a written diary entry.

For tests you may have purchased since July 1 last year but have discarded the receipts, you can still make a claim as long as you have some kind of record.

The Australian Taxation Office (ATO) states that your claim record needs to indicate what you purchased, when, where and how much you spent. The record must also be in English.

Can you claim COVID-19 tests already purchased?

For COVID-19 tests you may have purchased in the 2021-22 financial year, you can still claim them as the legislation will be backdated to July 1, 2021.

This means that any test purchased after the July 1 date will be covered in your tax claim. However, any tests purchased before this date will not be eligible to be claimed, even if you took the test in July or later.

Need help with your tax claims?

With government legislation frequently changing the way we do tax, it is important to seek the guidance of trusted tax professionals.

At LDB Group, we understand all the intricacies of tax claims for both individual income earners as well as businesses.

To find out how we can help you, call (03) 9875 2900 or send us a note via the contact form below.