LDB’s senior financial planner one of the first to participate in ASX Investor Forum

August 11, 2016

Financial planning strategies, diversification options and proposed superannuation changes were some of the topics covered by LDB at an ASX Investor Forum recently.

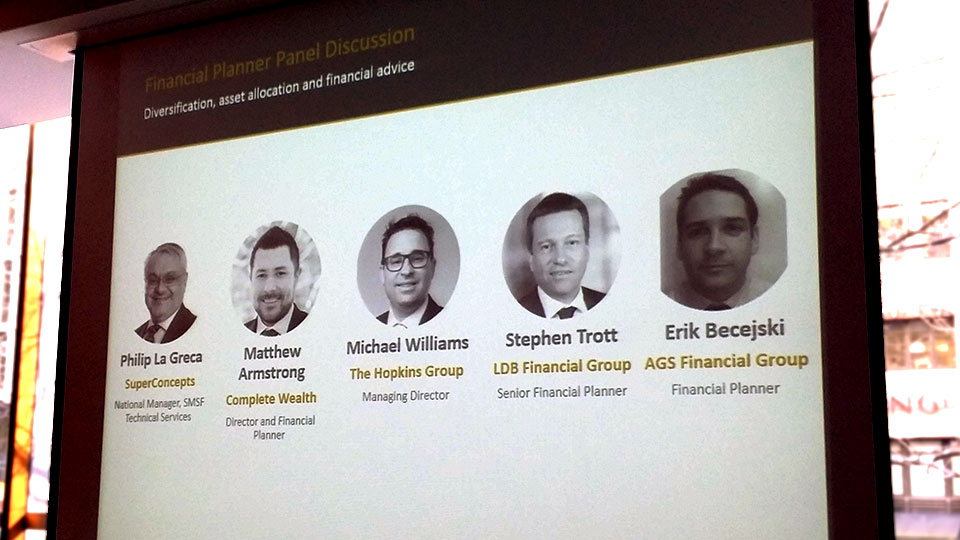

For the first time, ASX organisers invited financial planners to be part of the seminar, held on August 4 at CQ Melbourne, and LDB was put forward to provide invaluable advice.

More than 100 retail investors listened intently as LDB’s senior financial planner, Stephen Trott, discussed investment portfolio construction.

“We spoke about why financial planning advice is important, and how it helps people clarify their financial goals and set strategies in order to achieve those goals,” he said.

“Success in meeting new goals is determined by success in having a structured plan, and as a professional advisor, LDB is able to bring an independent viewpoint to your situation.

“We may be aware of issues that the investor isn’t, and therefore you should get a better outcome.”

Mr Trott elaborated on diversification options and whether to invest for income or for capital growth.

He also explained the different products available through the stock exchange, including Listed Investment Companies (LICs), Exchange Traded Funds (ETFs), mFunds and direct shares.

“People know about ordinary shares but there’s a range of other types of investment products that you can access through the exchange,” he said.

“It’s important to have investment in a range of asset classes because different types of investments have different risk and return characteristics.”

The Federal Government’s proposed changes to superannuation legislation sparked debate at the forum.

These changes include capping retirement phase account transfers at $1.6 million; increasing the tax on concessional contributions from 15 to 30 per cent (for those with combined incomes and superannuation contributions of more than $250,000); lowering the superannuation concessional contributions cap to $25,000 per year; and introducing a $500,000 lifetime cap for non-concessional contributions.

“We do expect there will be changes, but it’s not legislation yet and there might be some variation from what was originally put forward in the budget,” Mr Trott said.

“There’s likely to be impacts and opportunities and (it’s important to take) advice about how they impact your circumstances and strategy to ensure you’re getting the optimal outcome under the changes.”

LDB senior financial planner Tim O’Loughlin also attended.

The event included other speakers from the ASX and industry representatives, and afterwards LDB answered questions from guests at their trade stand.